Tony Robbins said “Setting goals is the first step in turning the invisible into the visible” but how do you set financial goals in a way so you can actually achieve them? Today I’d like to share some ideas for how to set financial goals in a way to have the greatest chance of success.

Every January we set New Year’s resolutions and yet only around 8% of us are able to stick to them by the end of the year. Why are we all so bad at keeping these promises to ourselves? The answer is different for everyone but one commonality for why goals often fail is due to unclear or vague goalsetting. Goals like “get out of debt” or “save more” simply aren’t specific enough.

While it is useful to start to think about which goals you want to pursue first as a way to prioritize them and which goals are a bit bigger sized that will need some extra time to accomplish, in the end you need more than just a list. You need a plan to make it happen! The way to improve your chances of reaching your goals, is to define them more specifically.

What exactly are you going to accomplish? For example, rather than saying you want to eliminate your debt, your goal should indicate paying off a specific amount of a specific debt. Your goal should also be measureable. What metrics will you use to track your progress? For example, rather than saying you want to simply “get better with your money” your goal should be trackable for instance “increase my emergency fund to 3 months of savings”. How much? How will you know when it’s done? Your goal should be attainable/achievable. Is your goal actually possible? And possible within the time frame you set. For example, don’t commit more than your useable income towards debt repayment (unless you have a whole bunch of personal belongings you plan to sell). Do you have the tools and support you need to accomplish this? Your goal should be relevant. Does this goal align with your other overarching financial goals? For example, if your long-term goal is to save for a house by next year, you wouldn’t want to divert all that money towards going on vacation. And your goal should be time-based. When is the deadline (or better yet, when are the multiple check in points) for reaching your goal? Also, maybe you need to set when you will begin working towards your goal. For example, instead of an opened ended “I want to save money or pay off debt” with no timeline in mind, you can set a goal with a target completion date such as “by September 1st, I want to have enough saved to purchase a new car”.

But it’s more than that – Personal Finance is very personal. You need to reflect on why you were unable to fulfill goals previously and think about what’s worked well to keep you motivated in the past. Maybe what works for you is to have an accountability partner. A friend to do activities with or someone to help keep you on track. Maybe it’s to automate savings or put savings in harder to reach places. What are some reasons why you have not fulfilled goals in the past? For example, if you found yourself in an emergency and had to tap your savings fund then maybe next time you need to make sure you have some cash reserves established first.

If you know your finances well – it’s possible to set up systems for yourself (like a budget aka spending plan) to help you succeed. Beyond your income covering just your expenses and nothing more, think about how you can make sure to carve out some of your income for financial goals. You could also set aside a particular amount to go towards goals or you could set up specific categories for specific things you’re working towards. You might even consider having separate bank accounts set up to help you keep your money separate and more easily see your progress.

Other ideas for keeping your goals front and center: Write down your goals – Create a vision board (like the example pictured here is an electronic vision board you could create in Canva and then set it as your computer desktop image or phone background) – Put your savings goal on a post-it note and keep it in your wallet as a reminder – Wrap a reminder around your credit card with a rubber band to make you think twice when you are tempted to pull it out to spend on something you don’t really need – Put a photo or postcard of what you’re saving for on the refrigerator

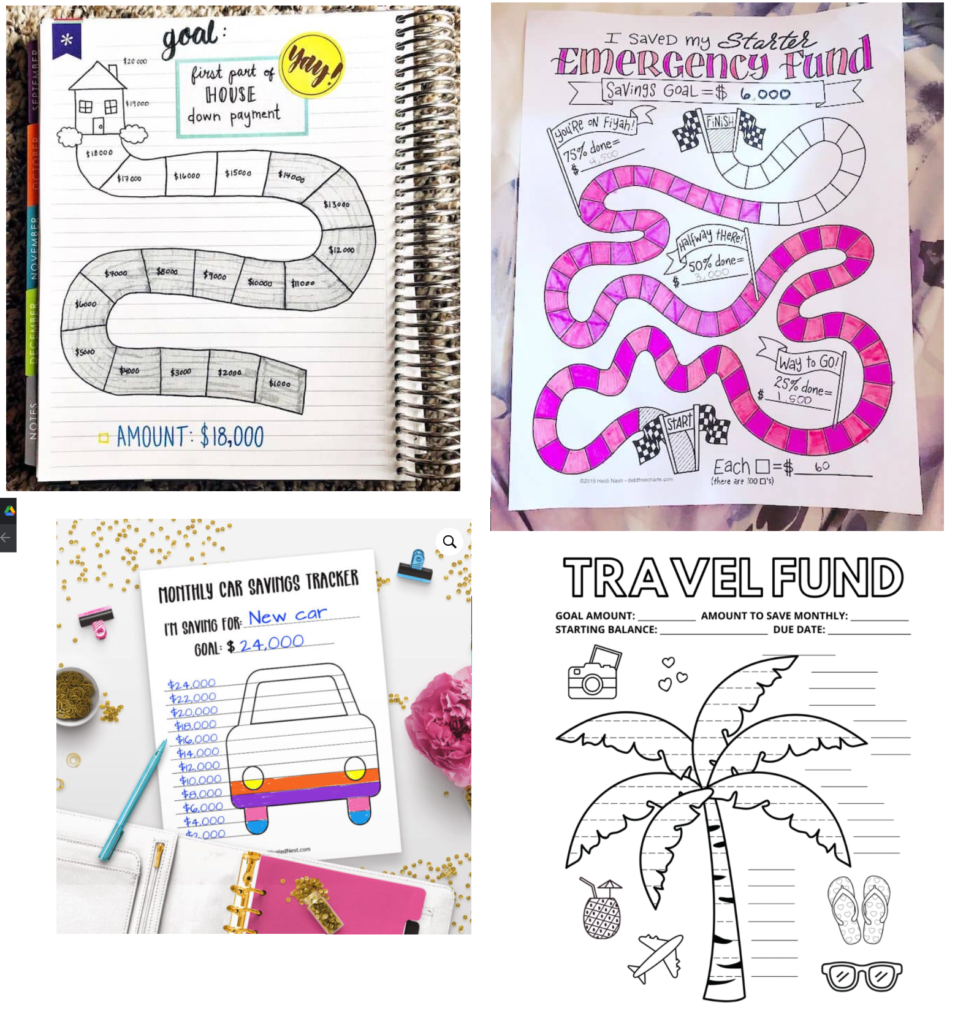

Using savings trackers is another idea for helping to keep you motivated. Celebrate milestones along the way. Here are some of my favorite examples I’ve found – you can try to find something you like on Etsy or make your own.

Keep in mind who you’re doing this for — your future you! Picture your future self going on the trip you want to go on or your future you enjoying retirement. Having extra savings can also give your future you added flexibility and open up options in situations where you’d otherwise feel stuck. If you need to change your living situation having a cash cushion would let you break your lease and change apartments or quit your job without notice if you needed to work somewhere different right away. Savings are also helpful reducing the stressfulness of the situation when emergencies come up – and they inevitably will come up. Set aside some extra savings — your future you will thank you!

1 thought on “How to Reach Your Goals”

Comments are closed.