Looking back at account balances from the beginning of my debt free journey in 2007, I had $17,000 in credit card debt, a $7,000 car loan, and $42,000 in student loan debt. A grand total of $66,000 of debt. My two best credit cards had interest rates around 10% then I had another at 16% and my two worst [store] cards were at 24% and 26%.

I remember feeling like I was living paycheck to paycheck and things always seemed really tight. I also remember paying as much as I could towards all of my credit cards but making little progress. I realize now I was fighting against all of the interest that was accumulating every month.

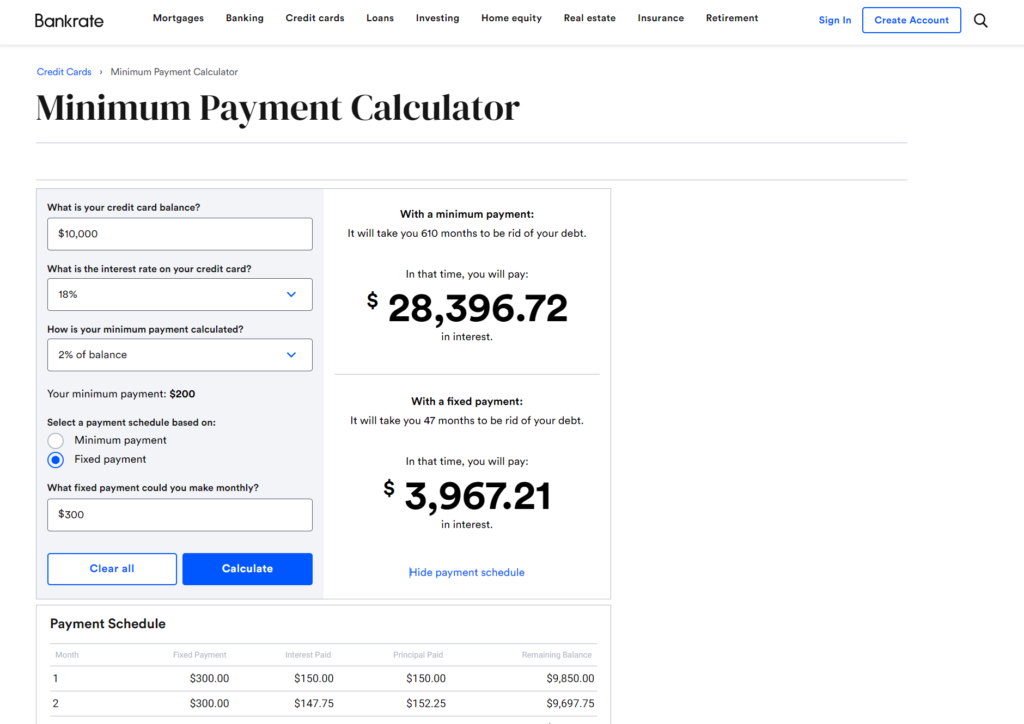

Here’s an example using my favorite minimum payment calculator from Bankrate. Based on a $10,000 balance at 18% and making payments of $300 per month, it would take 47 months to pay the card off. But, wait! Multiplying $300 by 47 is $14,100. That extra goes towards interest and it doesn’t happen all at once… interest factors in to every single payment.

As you can see in this example, of that $300 payment in the first month only $150 of it is going to pay down the balance of the card! The other half of the payment is going towards interest ($10,000 multiplied by 18% = $1,800 a year which divided by 12 breaks down to $150 for one month).

At some point, I started getting offers in the mail for new credit cards that contained convenience checks which, if used, could be written out to pay off the balance of my existing cards. The offers mentioned a 3% balance transfer fee that would be charged but whatever I moved to the new card would not accrue any interest for a certain number of months.

So, what this meant was that if I could get approved for a balance transfer deal, it would cost 3% to move what I owed to a different credit card. For the $10,000 example, that’s a one-time charge of $300 to do the deal. Not too shabby given that I would break even after just two months.

I remember some of the offers I was seeing offering 0% for 6 months, 9 months, and even 12 months. What this means is that for those months, your entire payment would go to paying down the balance and none of it would have to be applied to interest.

Here’s the crazy thing. Nowadays, there are banks with credit cards offering 0% balance transfers for 21 months. For convenience, here are links to the offers from two different banks and neither one charges an annual fee.. Please note these are not affiliate links and I am in no way compensated by sharing these cards. Applying for new credit cards can impact your credit score and you may not meet the banks credit qualifications.

Bank of America® BankAmericard®

https://www.bankofamerica.com/credit-cards/products/bankamericard-credit-card/

Citi® Citi Simplicity® Card

https://citicards.citi.com/usc/LPACA/Citi/Cards/Simplicity/ps/index.html?

Based on the example above, if you continued to pay $300 during the 0% period, you’d have less than $3,800 balance remaining to be paid after 21 months compared to still having $6,300 left to pay after 21 months in the 18% interest scenario.

That reprieve from interest is what helped me finally start to make progress. Your mileage may vary but drop me a comment if you try a similar approach.